Why the Edge Is Rising

The narrative around computing over the last decade has been dominated by the rise of the cloud. Enterprises centralized storage, analytics, and AI in hyperscale data centers, while consumers came to depend on services that lived “somewhere out there.” But as 2026 approaches, a new gravitational shift is underway: intelligence is moving outward, closer to devices, sensors, and people. This is the age of the edge.

In North America, the signs are unmistakable. Smart home adoption is mainstream, with nearly seven in ten households using at least one connected device. In parallel, enterprises are embedding sensors, AI models, and analytics directly into their operations—factories, hospitals, energy grids, and cities. What unites these deployments is the recognition that waiting for the cloud is too slow, too costly, and in some cases too risky.

Industry analysts now project that by 2025, more than 75% of enterprise data will be generated and processed outside traditional data centers. This is a massive leap from just 10% in 2018. The shift represents not just a technological upgrade but a wholesale change in where and how value is created in digital systems.

Market Momentum: A Data-Driven View

The market numbers tell the story of acceleration. Globally, the edge computing market was worth about $36.5 billion in 2021 and is forecast to more than double, reaching $87.3 billion by 2026. While this growth is worldwide, North America is the clear leader, accounting for more than a third of all edge spending.

The same trend plays out in IoT. Worldwide IoT spending is on track to exceed $1 trillion by 2026, up from about $805 billion in 2023. In North America, the IoT economy alone reached $182 billion in 2023 and is projected to grow more than sixfold to $1.2 trillion by 2030. These are not speculative numbers—they reflect concrete investments in devices, networks, and platforms that are already being deployed.

The smart home sector provides a consumer-facing microcosm of this trend. Valued at $35.8 billion in 2023, the North American smart home market is forecast to hit about $65 billion by 2026. By the end of the decade, it could surpass $145 billion, as AI-powered appliances, voice assistants, and home security systems shift from novelty to necessity.

Adoption Baseline: From Cloud-First to Edge-Native

This spending surge is not simply about adding more devices—it signals a fundamental architectural transformation. In the cloud-first paradigm, data was collected at the edge but shipped inward for processing. In the edge-native paradigm, devices themselves or local micro-data centers do the heavy lifting, analyzing information, running AI inference, and even making autonomous decisions in real time.

Businesses: A recent survey found that 81% of U.S. enterprises now pair AI with IoT, slightly above the global average. This indicates that most IoT deployments are already becoming intelligent at the edge, not just connected.

Consumers: Smart homes are evolving from passive device clusters into active, AI-driven ecosystems, where appliances learn, adapt, and optimize locally.

Ecosystems: Cloud providers, chipmakers, and startups are converging on hybrid architectures where the cloud serves as a “control plane” but the edge executes most of the intelligence.

This baseline shift matters because it reframes data itself as a local resource. Instead of raw sensor readings flowing upstream, only insights, exceptions, or aggregated patterns are sent to the cloud. The result: faster, cheaper, safer, and more resilient systems.

Six Drivers Accelerating Edge AI

The surge in edge computing adoption isn’t random—it’s propelled by a powerful set of structural drivers reshaping the digital landscape. Together, they explain why North America is embracing AI at the edge faster than anywhere else, and why the pace is expected to accelerate through 2026.

1. Latency and Real-Time Responsiveness

In an age of autonomous vehicles, telemedicine, and immersive AR/VR experiences, milliseconds matter. Cloud-based systems introduce unavoidable delays as data makes a round trip to distant data centers. Edge computing removes this bottleneck by processing data at or near the source.

A connected car can detect an obstacle and brake instantly without waiting on a cloud server.

A smart security camera can distinguish between a stray cat and an intruder in real time.

Industrial robots can halt production the moment a defect is detected.

For these applications, latency isn’t just inconvenient—it’s mission-critical.

2. 5G Rollout and Multi-Access Edge Computing

The North American rollout of 5G networks is enabling a new class of edge applications. Telecom operators are investing heavily in multi-access edge computing (MEC), embedding processing power at the base station level.

This creates a distributed infrastructure where devices, networks, and edge servers cooperate seamlessly, unlocking use cases like connected car safety systems, AR-guided surgeries, and city-wide IoT networks. By 2026, analysts expect 5G penetration to be deep enough to make real-time edge services a mainstream consumer expectation.

3. Privacy and Regulatory Pressure

With rising concerns about surveillance, data misuse, and cybercrime, keeping data local has become a strategic imperative. Regulations such as HIPAA (in healthcare) and evolving state-level privacy laws are pushing enterprises to analyze data where it’s created rather than transmitting everything to the cloud.

In practice:

Hospitals process patient scans on-premises, not in a public cloud.

Smart speakers now handle basic voice commands locally, reassuring privacy-conscious users.

Enterprises adopt “data minimization” strategies where only critical insights leave the device.

Edge AI satisfies both consumer trust and regulatory compliance.

4. Bandwidth and Cost Efficiency

Streaming terabytes of sensor data to the cloud is both expensive and unsustainable. Edge computing flips the model: raw data is filtered, compressed, or analyzed on-site, with only exceptions or summaries transmitted.

A smart factory might run computer vision locally to check thousands of products per hour, sending only defect reports to the cloud.

Utilities use local analytics on smart meters to adjust grid loads, reducing constant upstream data flow.

The savings are twofold: lower network strain and reduced cloud storage/processing costs.

5. Resilience and Offline Capability

In critical domains like healthcare, energy, or defense, downtime is unacceptable. Edge systems ensure that essential functions continue even when cloud connectivity drops.

A smart thermostat can maintain home comfort during an internet outage.

A drone in a remote location can navigate autonomously without a network connection.

A hospital infusion pump can detect a dosage error instantly, without relying on external servers.

Resilience is becoming a non-negotiable requirement, and edge delivers it.

6. Hardware Innovation: AI in Your Pocket

Perhaps the most underestimated driver is the explosion of edge AI hardware. Chips like NVIDIA’s Jetson, Google’s Coral TPU, Qualcomm’s Snapdragon AI Engine, and Intel’s Movidius VPU have made it possible to run powerful machine learning models on compact, energy-efficient devices.

These innovations mean:

Smartphones double as edge AI hubs.

Tiny sensors can run inference on-device (TinyML).

Consumer appliances—fridges, ovens, even washing machines—can execute AI tasks without external support.

By 2026, analysts expect the majority of new IoT devices to ship with built-in AI accelerators, making intelligence at the edge the default, not the exception.

Barriers and Challenges on the Edge

While the momentum behind edge AI is undeniable, the road to 2026 is not without obstacles. Adoption across smart homes, healthcare, and industrial IoT in North America faces five major challenges. Understanding these is critical for investors, enterprises, and policymakers who want to avoid overestimating the short-term and underestimating the long-term.

1. Security at Scale

Distributing intelligence across millions of endpoints creates an expanded attack surface. Unlike centralized cloud systems, where a small number of data centers can be tightly secured, edge deployments scatter devices across homes, cities, and industries.

A hacked smart thermostat can expose an entire home network.

Vulnerable hospital IoT devices could jeopardize patient safety.

Industrial sensors in the field may be physically tampered with.

Maintaining consistent, zero-trust security frameworks for thousands—or even millions—of devices is a daunting task. For North America, where consumer adoption is rapid and regulatory scrutiny is high, this remains the number-one concern.

2. Interoperability and Fragmentation

The IoT ecosystem has been plagued by fragmented standards. Consumers often face the headache of juggling devices that don’t communicate with one another, while enterprises wrestle with integrating legacy equipment with new platforms.

In smart homes, competing ecosystems (Google, Apple, Amazon, Samsung) have historically forced consumers to pick sides.

In industry, protocols vary by vendor, limiting plug-and-play compatibility.

The emergence of the Matter standard promises a solution by unifying smart home connectivity across brands, but industry-wide interoperability is still a work in progress. Until solved, fragmentation slows adoption and frustrates both end-users and developers.

3. Cost and Capital Expenditure

Edge infrastructure—whether it’s a smart appliance with a dedicated AI chip or a fleet of micro data centers—comes with significant upfront costs. While cloud services offer pay-as-you-go elasticity, edge deployments require hardware-heavy investments.

Consumers hesitate to replace “good enough” devices with smarter, pricier ones.

Enterprises must budget for both cloud and edge infrastructure, not one or the other.

Smaller businesses often lack the capital to implement advanced edge AI.

That said, as hardware costs fall and managed edge services proliferate, these financial barriers are expected to gradually soften by the late 2020s.

4. Management and Orchestration Complexity

Enterprises are discovering that while building one edge deployment is feasible, managing thousands is another matter entirely. Issues include:

Remote device monitoring and firmware updates.

Ensuring uptime and performance across heterogeneous hardware.

Balancing workloads between local edge nodes and the cloud.

Cloud providers are rushing to fill this gap—AWS, Microsoft, and Google all offer edge orchestration services—but skills shortages in IoT and edge engineering remain a bottleneck.

5. Scalability and Coverage Gaps

Not every geography can support ubiquitous edge deployments. Remote areas with weak connectivity, industries with geographically dispersed assets, and consumer markets outside urban centers may lag behind. This creates uneven adoption curves: dense cities and well-funded hospitals move quickly, while rural infrastructure and smaller enterprises face delays.

Hybrid models—where some functions remain cloud-based and others move to the edge—will likely persist through 2026 as organizations manage this uneven terrain.

The Balance of Risk and Opportunity

These challenges do not negate the growth trajectory. Instead, they frame the battlefield of innovation: security startups, interoperability alliances, chipmakers driving down costs, and cloud providers creating orchestration platforms. The companies that solve these problems fastest will capture disproportionate market share.

In short, the barriers are real—but so is the will to overcome them.

The Players and Platforms Leading the Edge Race

The shift toward AI-powered edge computing has ignited competition across multiple layers of the technology stack. Hyperscale cloud providers, chipmakers, and specialized IoT platforms are all racing to define standards, capture developer mindshare, and embed themselves into the fabric of edge-first architectures.

Hyperscalers: Extending the Cloud to the Edge

Amazon Web Services (AWS IoT Greengrass)

AWS leads with Greengrass, a runtime that extends cloud functions, AI inference, and data management to local devices. Enterprises use it to run machine learning models on IoT gateways, aggregate sensor data offline, and push insights to the cloud when needed. With AWS’s dominant ecosystem and developer tools, Greengrass is a default choice for many North American enterprises.Microsoft Azure IoT Edge

Microsoft positions Azure IoT Edge as a seamless bridge between the cloud and on-premises devices. It allows AI models, stream analytics, and custom code to run at the edge. Its integration with Azure’s enterprise services—identity management, security, DevOps—makes it attractive for regulated industries like healthcare and energy.Google Cloud & Coral

Google approaches edge from two angles: Coral hardware (edge TPUs for fast, efficient ML inference) and Google Cloud’s edge orchestration tools. Coral accelerators are especially popular in computer vision projects—drones, cameras, and robotics—while Google’s cloud-edge integration appeals to developers building AI-first consumer devices.

Chipmakers: Hardware Muscle at the Edge

NVIDIA Jetson

NVIDIA’s Jetson line is a powerhouse for robotics, autonomous vehicles, and vision-based IoT. Compact GPU-powered modules deliver high-performance AI inference in small form factors. Jetson has become the go-to choice for advanced robotics labs, smart camera vendors, and autonomous system developers across North America.Qualcomm Snapdragon AI Engine

Qualcomm dominates consumer IoT and mobile edge with its Snapdragon processors, embedding dedicated neural processing units (NPUs) into smartphones, AR/VR headsets, and smart home devices. As consumers demand faster, more private on-device AI, Qualcomm’s chips are the invisible backbone of millions of North American devices.Intel Movidius

Intel’s Myriad VPUs and Neural Compute Stick focus on low-power vision processing. These chips sit inside drones, VR headsets, and industrial cameras. Intel’s strategy emphasizes embedded edge AI for vision-intensive workloads—an area of growing importance in retail and industrial IoT.

Platforms and Ecosystem Innovators

IBM Edge Application Manager

IBM targets enterprise-scale orchestration. Its platform can deploy and autonomously manage thousands of AI models across dispersed edge nodes, appealing to industries like manufacturing, retail, and healthcare.HPE Edgeline

Hewlett Packard Enterprise focuses on rugged, data center-grade edge systems for industrial and energy deployments. Its hardware integrates compute, storage, and analytics at the network edge in harsh environments.Edge Impulse

A startup success story, Edge Impulse provides a platform for building and deploying TinyML models on embedded sensors. It empowers developers to put intelligence directly on microcontrollers and wearables, a fast-growing subsegment of IoT.Standards and Alliances (CSA, Matter)

Alongside vendors, standards bodies are critical players. The Connectivity Standards Alliance (CSA) launched Matter, now backed by Apple, Google, Amazon, and Samsung, to ensure interoperability in smart homes. Matter’s emphasis on local edge communication could be the tipping point for mass consumer adoption.

Landscape Outlook

This competitive landscape reveals a multi-front race:

Hyperscalers are embedding edge into their cloud ecosystems.

Chipmakers are making AI inference feasible in everything from drones to doorbells.

Platforms and alliances are solving orchestration and interoperability.

By 2026, we can expect to see consolidation—through acquisitions of smaller edge innovators—and hybrid strategies where cloud, edge, and device intelligence co-exist. The winners will be those that can balance scale with flexibility, meeting both consumer and enterprise needs across North America.

Notable Use Cases: The Edge in Action

Edge computing isn’t just an abstract concept—it’s reshaping how people live, work, and consume services across the continent. By 2026, these applications will move from pilot projects and early adopters into the mainstream.

Smart Homes: From Gadgets to Autonomous Ecosystems

Smart homes have evolved from a collection of connected devices to intelligent, coordinated systems. Edge AI is enabling:

On-device voice assistants that process commands instantly and privately, without sending audio to the cloud.

Smart cameras and doorbells that recognize faces or detect intruders in real time, reducing false alarms and keeping video data local.

Energy optimization as thermostats and appliances learn household patterns and make real-time adjustments to save money and reduce waste.

The launch of the Matter standard ensures these devices can interoperate seamlessly. By 2026, consumers will expect a home that “just works” — where AI-powered devices collaborate locally for comfort, security, and efficiency.

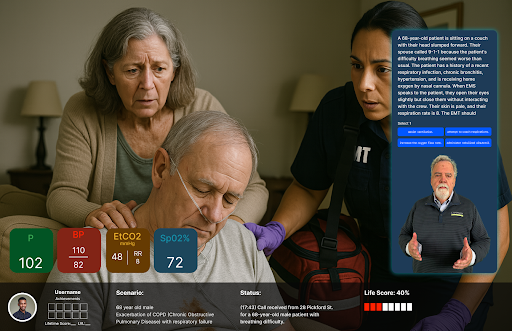

Healthcare: Real-Time Care at the Bedside

Healthcare is one of the most transformational domains for edge AI in North America. Examples include:

Smart hospitals with edge nodes that analyze high-resolution imaging scans on-site, delivering instant diagnostic insights.

5G-enabled AR and VR surgical systems powered by local edge servers, allowing specialists to operate or consult in real time.

Remote patient monitoring devices—smart patches, glucose monitors, wearables—that detect anomalies on-device and alert caregivers instantly.

By 2026, nearly half of new hospitals in North America are expected to operate with dedicated edge infrastructure, making real-time AI an everyday part of healthcare delivery.

Energy and Utilities: Building Smarter Grids

North America’s energy transition depends heavily on edge intelligence. Utilities and consumers are using it to:

Balance loads in real time with smart meters and local controllers.

Manage microgrids that integrate solar, wind, and storage with local decision-making.

Power EV charging infrastructure that dynamically adjusts loads based on demand and grid conditions.

These edge-first systems not only prevent outages but also cut costs and emissions, making them central to national sustainability goals.

Industry and Manufacturing: Predictive and Autonomous

Factories are becoming data-driven ecosystems powered by edge computing:

AI cameras on production lines catch defects the moment they occur.

Vibration and temperature sensors run local ML models to predict equipment failures.

Autonomous robots and AGVs (automated guided vehicles) navigate warehouses with on-device AI.

The result is higher uptime, better quality control, and safer operations—all made possible by localized analytics.

Smart Cities, Retail, and Agriculture

Other domains are quickly following:

Cities deploy edge AI to manage traffic, optimize lighting, and improve public safety.

Retailers use local analytics for cashierless checkout, inventory management, and personalized in-store experiences.

Farms run irrigation, pest detection, and crop optimization based on sensor analytics at the edge, critical in rural areas with limited connectivity.

The Common Thread

Across homes, hospitals, grids, and cities, the common thread is the same: data is being analyzed and acted upon where it’s created. This results in faster responses, better privacy, and more resilient systems.

By 2026, edge AI will be woven into the daily lives of North Americans — sometimes visible (like a smart camera that alerts you instantly), sometimes invisible (like a grid silently rerouting power around a failure).

Conclusion & Outlook: The Edge Is Not Optional

By 2026, the edge will no longer be a fringe architecture—it will be the default environment for AI-powered IoT in North America. The numbers are compelling:

Smart home spending surging toward $65 billion by 2026.

IoT investment exceeding $1 trillion globally.

Edge computing climbing past $87 billion in market value.

This is more than growth; it is a reorientation of the digital economy. The story of the 2010s was the rise of the cloud. The story of the mid-2020s will be the rise of the edge.

Strategic Implications for Stakeholders

Enterprises

Companies cannot afford to treat edge as an experiment. Hybrid cloud–edge strategies should be designed now, with pilots in latency-sensitive, high-ROI areas such as predictive maintenance, real-time analytics, and customer-facing IoT. Investing in edge orchestration platforms and partnering with hardware leaders will be critical.Consumers & Smart Home Ecosystem

Interoperability standards like Matter should be embraced by device makers, ensuring frictionless adoption. For consumers, edge means faster, safer, and more private experiences—making smart homes more compelling than ever.Healthcare Providers

Hospitals and clinics must integrate edge infrastructure into digital transformation strategies. The ability to process imaging, monitor patients, and even run AR surgery systems locally is not just a cost saver but a life saver. Early adopters will set new benchmarks in patient outcomes and efficiency.Utilities and Energy Players

Edge will be the linchpin of resilient smart grids. Operators should invest in local controllers, smart meters, and edge AI for load balancing, renewables integration, and outage prevention. This is not only an efficiency play—it’s essential to meeting climate and electrification targets.Policymakers & Regulators

Security, privacy, and interoperability challenges demand proactive oversight. Policymakers should support standards adoption, cybersecurity frameworks, and public-private investment in edge infrastructure. Regulation that lags behind adoption risks undermining consumer trust.

The Road Ahead

The next two years represent a critical window. By the time we cross into 2026, the edge will be deeply embedded in homes, hospitals, factories, and cities. The winners will be those who:

Move early to integrate edge-native architectures.

Align with the strongest ecosystem partners (AWS, Azure, NVIDIA, Qualcomm, Coral, etc.).

Invest in solving the barriers: security, interoperability, and orchestration.

The edge is not replacing the cloud; it is complementing and decentralizing it. Together, they form the backbone of the next digital era—one where intelligence lives everywhere, from the kitchen counter to the power grid.

In the words of one analyst, “The future isn’t in the cloud or at the edge. It’s in the interplay between them.” For North America, that interplay will define a trillion-dollar market and a decade of innovation.

Market Size & Forecasts

Fortune Business Insights – Edge Computing Market Size, Share, Growth:

https://www.fortunebusinessinsights.com/amp/edge-computing-market-103760Markets and Markets – Edge Computing Market:

https://www.marketsandmarkets.com/PressReleases/edge-computing.aspMordor Intelligence – Edge Computing Market:

https://www.mordorintelligence.com/industry-reports/edge-computing-marketScoop / Market.us – Edge Computing Statistics:

https://scoop.market.us/edge-computing-statistics/Precedence Research – Edge AI Market:

https://www.precedenceresearch.com/edge-ai-marketResearch Nester – Connected IoT Devices Market:

https://www.researchnester.com/reports/connected-iot-devices-market/6772IoT Analytics – Number of Connected IoT Devices:

https://iot-analytics.com/number-connected-iot-devices/

Foundational Definitions & Context

Wikipedia – Edge Computing:

https://en.wikipedia.org/wiki/Edge_computingWikipedia – Internet of Things:

https://en.wikipedia.org/wiki/Internet_of_things

Academic Perspectives

Zhi Zhou et al. (2019) – Edge Intelligence: Paving the Last Mile of Artificial Intelligence With Edge Computing:

https://arxiv.org/abs/1905.10083Habib Larian et al. (2025) – InTec: Integrated Things-Edge Computing:

https://arxiv.org/abs/2502.11644

Add Row

Add Row  Add

Add

Write A Comment